Argentine peso slides 9% after IMF loan deal

The Argentine peso slid around 9% while bonds gained after Buenos Aires sealed a $20 billion loan program with the International Monetary Fund and undid large parts of its currency and capital controls.

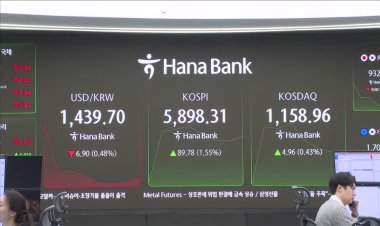

The peso dropped to around 1,170 per dollar, paring initial losses from prices set as low as 1,290 pesos, after the central bank undid its so-called "crawling peg" and allowed the currency to float freely within a far wider trading band of 1,000-1,400 pesos per dollar.

The currency had closed at 1,074 per dollar, though popular parallel rates ARSB= often used by Argentines and local firms to access greenbacks, due to strict capital controls in place since 2019, had been nearer 1,350 per dollar.

Those parallel rates strengthened, narrowing the gap to the official rate, a sign that markets were starting to digest and even celebrate the policy shift that is seen as helping in the long-run to erase exchange rate distortions.

The country's international bonds, meanwhile, rallied with some maturities adding more than 4 cents in the dollar, according to data from MarketAxess. Meanwhile the Global X MSCI Argentina ETC gained 5.3% in premarketARGT.P.

The IMF support is seen boosting overall confidence and the removal of controls could help spur investment.

The IMF deal will release an initial $12 billion, with $3 billion more coming later in the year. Argentina also announced large loan deals with other multinational lenders and banks that should help bolster its depleted foreign currency reserves.

The South American grains producer is digging itself out of a major economic crisis under libertarian President Javier Milei, who came to office in late 2023 and has managed to stabilize the economy with austerity and fiscal discipline.