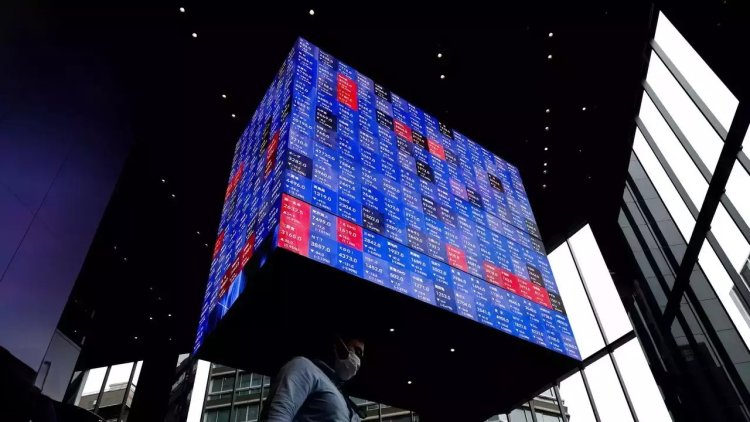

Chinese stocks see biggest rally since 2008

Chinese stocks have experienced their most significant rally since 2008, with the CSI 300 index of Shanghai- and Shenzhen-listed companies surging 15.7% this week. This remarkable performance comes in response to Beijing's aggressive economic stimulus package, the most substantial since the pandemic.

The blue-chip CSI300 index rose over 4%, culminating in a weekly gain of nearly 16%. Hong Kong's Hang Seng index mirrored this trend, jumping over 12% for the week, marking its largest weekly increase since October 1998 during the Asian financial crisis.

This surge follows Beijing's announcement of a comprehensive stimulus package, including a $114 billion lending pool for capital markets. The measures, previewed earlier in the week by central bank governor Pan Gongsheng, include cuts to key interest rates, additional support for mortgage borrowers, and a reduction in banks' reserve requirements to boost lending capacity.

The property sector, which has been burdened by massive developer debts and excess housing inventory, saw significant gains with shares rising around 8%. Reports of Shanghai and Shenzhen potentially removing remaining curbs on home sales further bolstered the sector.

The government is also planning fiscal support, with reports suggesting the issuance of approximately $284 billion in new bonds.

This rally has had positive spillover effects on European markets and industrial metals. The Stoxx 600 in Europe reached a new record high, boosted by luxury goods companies that stand to benefit from stronger Chinese consumer spending.

The stimulus package includes funds for companies to buy back their shares and for non-bank financial institutions like insurers to invest in local equities. This comprehensive approach aims to support capital markets, stabilize the property sector, and boost domestic consumption.