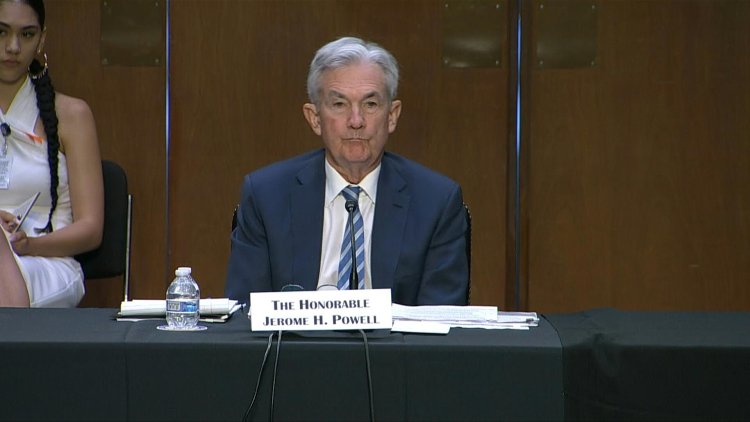

US could face more inflation 'surprises': Fed's Powell

The US economy is strong but faces an "uncertain" global environment and could see further inflation "surprises," Federal Reserve Chair Jerome Powell said.

In the first of two closely-watched days of testimony to Congress, Powell again stressed that the Fed understands the hardship caused by rising prices and is committed to bringing down inflation, which has reached a 40-year high.

The US central bank last week announced the most aggressive interest rate increase in nearly 30 years and promised more action to come to combat the price surge, with gas and food costs soaring and millions of Americans struggling to make ends meet.

But as fears mount that the rapid tightening of financial conditions could go too far and tip the world's largest economy into recession, Powell insisted the US economy "is very strong and well positioned to handle tighter monetary policy."

"Inflation has obviously surprised to the upside over the past year, and further surprises could be in store," the Fed chief told the Senate Banking Committee in his semi-annual appearance.

Policymakers "will need to be nimble" given that the economy "often evolves in unexpected ways," he said.

Last week's super-sized 0.75-percentage-point increase in the benchmark lending rate was the third since March, taking the policy rate up a total of 1.5 points. And Powell at the time said more such increases were likely in July.

The Fed is facing intense criticism that it was too slow to react to the changing economy, which benefited from a flood of federal government stimulus.

Powell made no explicit mention of recession risks in his opening remarks, but was sure to be grilled about the prospect by senators.