Australia expands grain-fed beef output

Rising demand and tight U.S. supply drive rapid feedlot growth

Six thousand Black Angus cattle stand in shaded pens at the Gundamain feedlot in Eugowra, central New South Wales, where animals gain up to 200 kilograms over about 90 days on a ration of rolled barley, silage, cottonseed and molasses. The lot’s owners plan to double capacity to 12,000 head as Australia rapidly expands grain‑fed beef production to meet rising global demand for marbled, high‑quality meat.

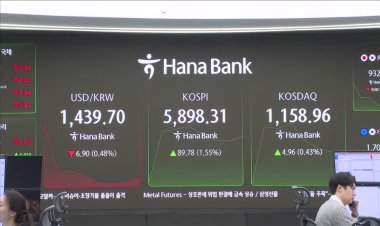

Industry data show cattle “on feed” in Australia reached a record 1.6 million by mid‑2025, up from about 1 million five years earlier, with analysts forecasting roughly 2 million by 2027—by then about half of Australia’s cattle are expected to pass through feedlots before slaughter. The growth reflects structural change in a country long known for vast pasturelands and large export volumes: Australia shipped beef worth $8.6 billion in the first nine months of the year and is increasingly supplying markets that prize grain‑fed beef, notably Japan, South Korea and China.

The expansion is reinforced by a contraction in U.S. cattle numbers after years of drought; the U.S. herd on feed has fallen to levels not seen in decades, reducing its export capacity and creating an opening for Australian suppliers. Government statistics show Australian grain‑fed exports rose to 324,421 tonnes in the first nine months of the year from 224,230 tonnes in the same period of 2020, a rise driven largely by longer‑fed cattle eligible under the 100‑day definition used in official counts.

Producers say feedlot systems help stabilise supply by reducing reliance on variable pasture growth and extreme weather swings that characterise Australian agriculture. While more animals are being fattened on grain, analysts do not expect Australia to mirror the U.S. model—where over 90% of cattle are finished in feedlots. Instead, forecasts envisage a near even split between grain‑fed and grass‑finished production, enabling exporters to serve both premium marbled‑beef markets and consumers seeking grass‑fed products.

For Asian importers accustomed to U.S. grain‑fed quality, Australia is emerging as a close substitute, offering consistent volumes and competitive pricing as U.S. output tightens. The industry frames the feedlot boom as a strategic response to global demand and shifting supply dynamics: expanded feedlot capacity, rising export volumes and investment in grain‑finishing aim to position Australia as a larger, more reliable supplier of grain‑fed beef in coming years.